Understanding Cryptocurrencies: A Comprehensive Guide

Introduction

Cryptocurrencies have become a buzzword in the financial world over the past decade. These digital or virtual currencies use cryptography for security and operate independently of a central authority. This article delves into the fundamentals of cryptocurrencies, their advantages and disadvantages, and their potential impact on the future of finance.

What Are Cryptocurrencies?

Cryptocurrencies are decentralized digital assets that rely on blockchain technology to record and verify transactions. Unlike traditional currencies issued by governments, cryptocurrencies are created and managed through cryptographic algorithms. The most well-known cryptocurrency is Bitcoin, but thousands of alternatives, known as altcoins, exist, including Ethereum, Ripple, and Litecoin.

How Cryptocurrencies Work

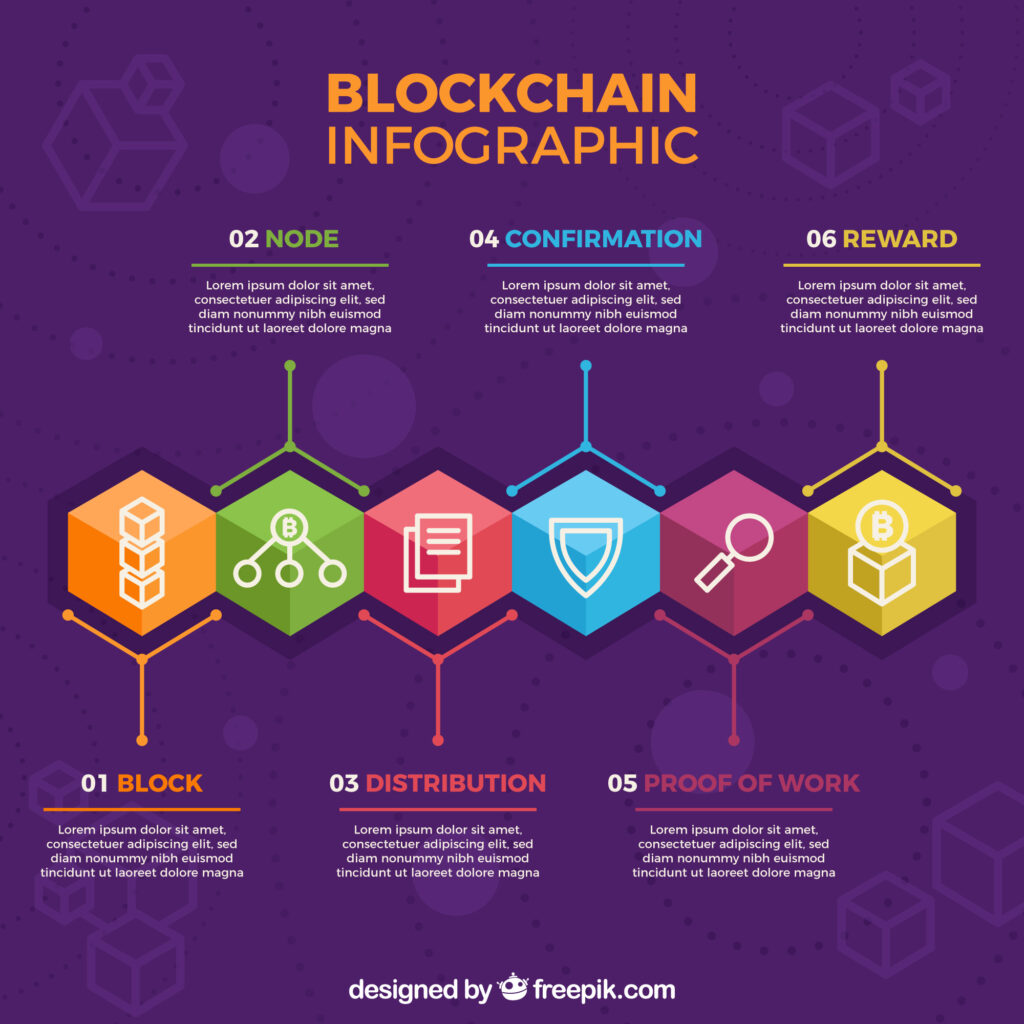

At the core of cryptocurrencies is the blockchain, a distributed ledger that records all transactions across a network of computers.Each transaction is bundled into a block , which is then added to the chain in a linear, chronological order. This process is maintained by a network of nodes (computers) that validate and relay transactions.

Key Features of Cryptocurrencies

- Decentralization: Cryptocurrencies are not controlled by any central authority, making them resistant to government interference and manipulation.

- Security: Cryptographic techniques secure transactions and control the creation of new units, making cryptocurrencies difficult to counterfeit.

- Transparency: All transactions are recorded on a public ledger, ensuring transparency and accountability.

- Anonymity: While transactions are public, the identities of the participants are typically pseudonymous, enhancing privacy.

Advantages of Cryptocurrencies

- Lower Transaction Costs: Cryptocurrency transactions often have lower fees compared to traditional financial systems, especially for cross-border transfers.

- Financial Inclusion: Cryptocurrencies can provide access to financial services for unbanked and underbanked populations around the world.

- Speed: Transactions can be completed in minutes, regardless of the participants’ locations, compared to traditional banking systems that can take days.

- Inflation Resistance: Many cryptocurrencies have a fixed supply, reducing the risk of inflation that affects fiat currencies.

Disadvantages of Cryptocurrencies

- Volatility: Cryptocurrencies are known for their price volatility, which can be a barrier to their adoption as a stable medium of exchange.

- Regulatory Uncertainty: The regulatory environment for cryptocurrencies is still evolving, and changes can impact their value and legality.

- Security Risks: While the underlying technology is secure, exchanges and wallets can be vulnerable to hacking and fraud.

- Limited Acceptance: Despite growing popularity, cryptocurrencies are not widely accepted as a payment method compared to traditional currencies.

The Future of Cryptocurrencies

The future of cryptocurrencies holds significant potential. As blockchain technology matures, we can expect to see increased adoption and integration into various sectors, including finance, supply chain management, healthcare, and more. Innovations like decentralized finance (DeFi) are already showing how cryptocurrencies can create more inclusive and efficient financial systems.

Moreover, central bank digital currencies (CBDCs) are being explored by several governments, potentially bridging the gap between traditional finance and the cryptocurrency world. As regulatory frameworks become clearer, cryptocurrencies could gain more legitimacy and stability, encouraging broader acceptance.

Conclusion

Cryptocurrencies represent a revolutionary shift in the world of finance, offering numerous advantages such as lower transaction costs, financial inclusion, and enhanced security. However, challenges like volatility, regulatory uncertainty, and security risks remain. As the technology and regulatory landscape evolve, cryptocurrencies have the potential to become a mainstream component of the global financial system, driving innovation and financial democratization.